Secure

Segregated

Verifiable on the blockchain

Regulated

Broad asset coverage

CUSTODY

Digital asset custody. Built by institutions, for institutions.

Segregated, transparent custody

At Komainu, our custody services prioritise transparency, utilising segregated on-chain wallets to store client assets. We do not use any form of omnibus wallet or off-chain ledger, ensuring separation and transparency of assets. By making your assets viewable on-chain, we eliminate any concerns around the co-mingling.

Institutional-grade technology

We use institutional-grade technology to safeguard your assets, utilising Hardware Security Module (HSM) Vaults and Multi-Party Computation (MPC) wallets. These robust security measures provide protection against cyber threats and human error, ensuring the safety of your digital assets.

Resilient end-to-end security

We employ resilient end-to-end security design. Our measures include 24/7 network monitoring, segregated networks, regular external penetration tests, and compliance with SOC 2 Type I, SOC 1 Type II, ISO27001 and ISO27701 standards.

Your trusted partner

Assets are held off-balance sheet and fully segregated on-chain to create an insolvency-remote trust structure.

White glove service

Our services are designed to cater to the unique needs of each individual client. We prioritise technology neutrality, allowing us to adapt and tailor our solutions to meet your specific requirements.

Regulated

Komainu has an OAM registration in Italy, an MLR registration with the UK Financial Conduct Authority (FCA) and is regulated by the Jersey Financial Services Commission (JFSC) in Jersey and Dubai Virtual Assets Regulatory Authority (VARA) in the UAE.

Token Coverage

We support custody for 40+ native blockchains and ~6000 tokens

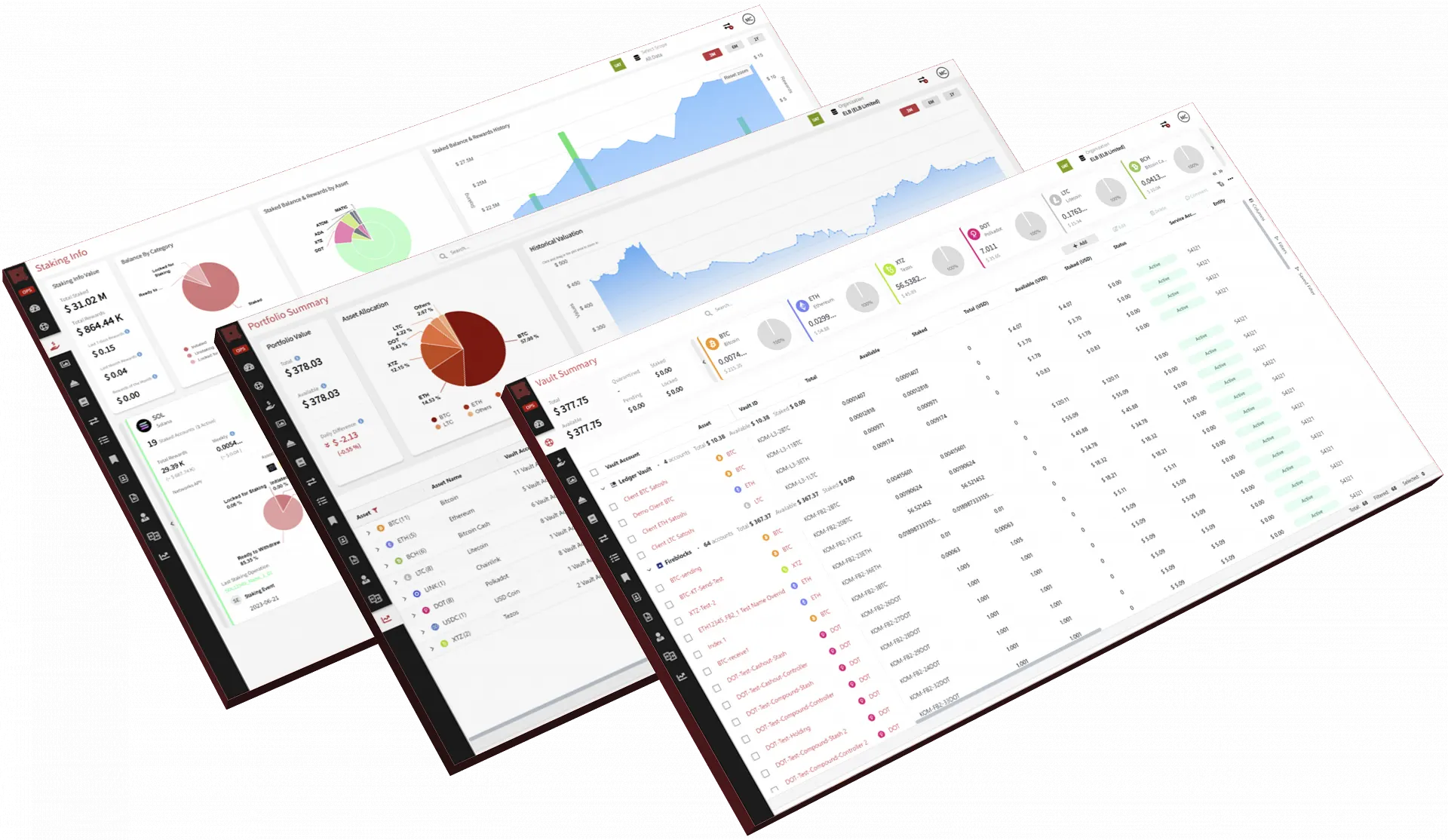

Data and reporting

Reporting, built for institutions. The Komainu reporting portal delivers exceptional reporting capabilities, combining cutting-edge technology, independent verification, data aggregation, customisation options, and a comprehensive portfolio view to elevate your reporting journey. Experience the power of transparent and insightful reporting from our portal.

NEWS AND INSIGHTS

Latest news and insights